Bitcoin Price Trajectory: 2025-2040 Outlook Amid Current Market Dynamics

#BTC

- Technical Support Levels: Bitcoin trading near Bollinger Band lower boundary suggests potential buying zone around $105,700

- Market Maturity Indicator: Absence of capitulation despite 13% decline shows growing investor sophistication

- Institutional Developments: Leveraged ETF filings and mining company funding indicate continued professional interest

BTC Price Prediction

Technical Analysis: Bitcoin Shows Consolidation Patterns Amid Market Correction

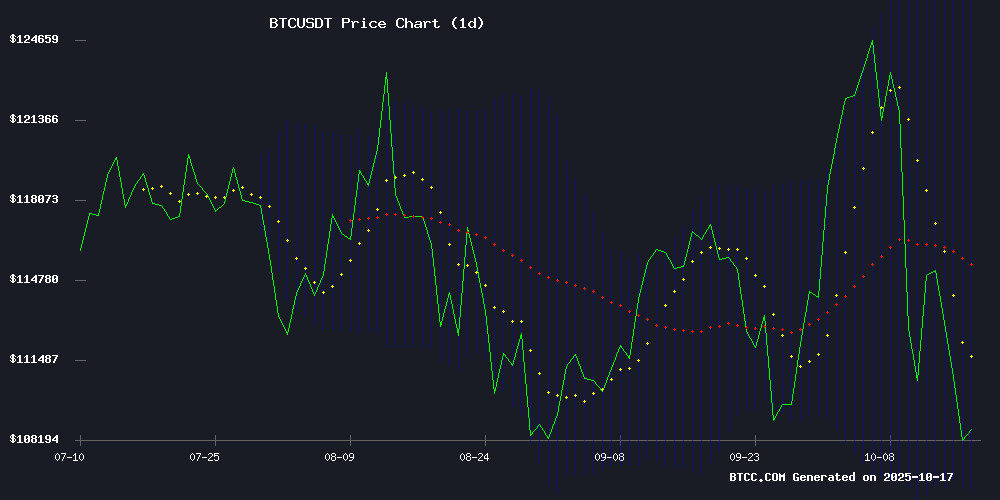

According to BTCC financial analyst Sophia, Bitcoin's current technical indicators suggest a period of consolidation following the recent market correction. The price of $106,852.14 sits below the 20-day moving average of $116,554.80, indicating short-term bearish pressure. However, the MACD reading of 1,218.88 shows some positive momentum, while the Bollinger Bands position suggests Bitcoin is trading near the lower band at $105,703.83, which could indicate a potential support level.

Sophia notes that 'the technical setup points to a market finding its footing after the recent decline. The proximity to the lower Bollinger Band often signals potential buying opportunities for long-term investors.'

Market Sentiment: Fear Dominates as Bitcoin Faces Multiple Headwinds

BTCC financial analyst Sophia observes that current market sentiment reflects extreme fear amid global trade tensions and miner selling pressure. 'The combination of geopolitical factors, including the US-China trade war confirmation, and technical factors like miners depositing 51,000 BTC to exchanges creates a challenging environment,' Sophia states. However, she emphasizes that 'the absence of capitulation and steady long-term holder behavior suggests this is more consolidation than crisis.'

Sophia adds that 'the market maturity displayed during this correction, coupled with institutional developments like the 21Shares Leveraged ETF filing, provides underlying strength despite short-term pressures.'

Factors Influencing BTC's Price

Bitcoin Slides 13% Amid Market Correction, Analysts Eye Buy Zone

Bitcoin has tumbled more than 13% in the past week, trading NEAR $105,000 as risk assets face broad selling pressure. The downturn coincides with renewed interest in gold markets, though some traders view the drop as a strategic entry point.

Analyst Michaël van de Poppe identifies $104,000-$106,000 as a key accumulation zone, noting this range has historically provided support. "In these ranges, it's getting into buy the dip area," he observed. Downside levels to watch include $103,190 and the psychological $100,700 threshold.

A decisive break above $112,000 could signal momentum returning, with potential targets at $119,500 and beyond. The weekly chart shows Bitcoin testing the 21-week EMA - a critical mid-cycle indicator that's previously marked turning points during bull markets.

Bitcoin Retreats Toward $100,000 as Trade Tensions Rattle Crypto Markets

Bitcoin's descent toward the $100,000 mark accelerates as geopolitical strains erase October's gains. The cryptocurrency now barely outpaces the S&P 500 this year, trading near $107,000 with a 14% year-to-date return.

The collapse of bitcoin's safe-haven narrative has severed its correlation with gold, which continues attracting capital amid record highs. "Gold is the new bitcoin," declares Yardeni Research's president, underscoring the market's shifting preferences.

Crypto-linked equities mirror the downturn. MicroStrategy, Coinbase, and Circle have all shed over 5% this week. The sector faces mounting pressure as trade conflicts between Washington and Beijing dampen risk appetite.

Bitcoin’s $105K Drop Highlights Market Maturity as Long-Term Holders Hold Steady

Bitcoin's latest $105,000 plunge reveals a transformed market landscape in 2025, where long-term investor behavior diverges sharply from previous cycles. Exchange reserves now sit at decade lows—a stark contrast to past sell-offs that flooded trading platforms with panic-driven supply.

The structural shift becomes clear when comparing market reactions. During 2020-2021 corrections, exchange inflows spiked as traders rushed to exit positions. Today's record-low exchange balances suggest constrained sell-side liquidity, turning volatility events into tests of market depth rather than catalysts for cascading liquidations.

"With exchange reserves shrinking and long-term holders steady, temporary volatility does not equate to structural weakness," observes CryptoQuant's analysis. This resilience reflects Bitcoin's maturation—where institutional custody solutions and accumulation strategies now buffer against retail-driven panic.

No Capitulation, Just Consolidation: What This Bitcoin (BTC) Correction Really Signals

Bitcoin (BTC) dipped below $105,000 amid renewed selling pressure, sparking comparisons to past cycles. On-chain data reveals a structurally stronger market in 2025 compared to 2020 or 2021, with exchange reserves near decade lows. This scarcity of available supply limits prolonged selloffs and fosters quicker stabilization.

Long-term holders remain steadfast, selectively realizing profits rather than panic-selling. The Long-Term Holder Spent Output Profit Ratio (LTH-SOPR) hovers near neutral, contrasting sharply with previous capitulation phases. Historical patterns suggest resilience: the March 2020 crash cleared excess leverage before whales re-entered, while the May 2021 cycle saw large wallets selling high and buying low. The August 2023 rebound after the US debt downgrade further underscored the market’s ability to absorb shocks.

The current correction reflects consolidation, not capitulation. With leaner supply and disciplined holders, Bitcoin’s foundation appears poised for recovery.

Bitcoin Miners Flood Binance With 51K BTC — Is A Sell-Off Imminent?

Bitcoin miners have shifted behavior dramatically, depositing 51,000 BTC worth $5.7 billion into Binance since October 9. The movement, tracked by on-chain analytics, marks the largest miner-to-exchange transfer since July 2024. A single October 11 spike saw 14,000 BTC hit exchange wallets hours after a market plunge erased $20 billion in Leveraged positions.

While exchange inflows often signal selling pressure, CryptoQuant notes alternative explanations—collateral for futures, operational financing, or strategic rebalancing. The scale nevertheless rattled traders, with bitcoin briefly testing $104,000 during the October 10 liquidation cascade. Market sentiment now hinges on whether these flows represent capitulation or calculated positioning ahead of the halving.

Pig Butchering Scam Exposed: How US Seized KingPing $15B Bitcoin

Chen Zhi, a notorious figure in Cambodia's underworld, built a crypto empire that allegedly generated millions daily across international borders. The operation collapsed when US authorities seized $15 billion in Bitcoin linked to pig-butchering scams—a scheme where victims are fattened with false promises before being defrauded.

The seizure marks one of the largest crypto-related enforcement actions in history. Investigators traced the assets through blockchain forensics, revealing complex money laundering networks spanning multiple jurisdictions. No exchanges were directly implicated in the court filings.

Trump Confirms US Is in a Trade War With China — Bitcoin Feels the Sting

President Donald TRUMP has officially declared the United States is engaged in a trade war with China, confirming earlier threats to impose a 100% tariff on Chinese imports. The announcement sent shockwaves through cryptocurrency markets, with Bitcoin plunging nearly 15% from $121,560 to below $103,000 within hours.

The market reaction underscores Bitcoin's growing sensitivity to macroeconomic tensions. Trump framed tariffs as a national security necessity, stating "We're in one now" when questioned by WHITE House reporters. His Friday social media post foreshadowing the 100% tariffs triggered the crypto selloff, coinciding with China's move to restrict rare earth mineral exports critical for semiconductors.

Treasury Secretary Scott Bessent amplified the rhetoric this week, condemning China's trade practices during a global trade briefing. The escalating conflict between the world's two largest economies has created risk-off sentiment across digital assets, with traders flocking to traditional SAFE havens.

Crypto Market Plunges into Extreme Fear as Bitcoin Struggles Amid Global Tensions

The cryptocurrency market has rapidly shifted from greed to extreme fear, with sentiment indices collapsing over the past week. Alternative.me's Fear & Greed Index plummeted 42 points to 22, while CoinMarketCap's counterpart dropped to 28, signaling widespread trader caution.

Bitcoin's price action reflects the deteriorating sentiment, struggling to maintain support near $110,000 as US-China trade tensions sparked a flight to traditional safe-havens. Gold surged to record highs above $4,230/oz, while US spot Bitcoin ETFs saw $94 million in outflows on Wednesday alone.

The derivatives market showed mounting pressure, with overleveraged traders facing $418 million in liquidations. Long-term holders contributed to selling pressure, offloading 265,700 BTC in the past month - a concerning sign for market stability.

Public Mining Companies Raise Billions in Debt to Fund AI Pivot

Bitcoin mining firms are undergoing a strategic transformation, leveraging debt markets to finance expansions into artificial intelligence infrastructure. Bitfarms and TeraWulf have spearheaded this shift with $500 million and $3.2 billion debt offerings respectively, part of a broader industry trend that saw public miners raise $4.6 billion in Q4 2024.

The capital strategy mirrors MicroStrategy's successful playbook but introduces new risks. Convertible notes now dominate financing structures, replacing equipment-collateralized loans from the 2021 cycle. This approach reduces immediate liquidation threats but increases potential equity dilution—a tradeoff that demands accelerated revenue growth to maintain shareholder value.

Market observers note the parallel with tech industry pivots, where infrastructure-heavy companies repurpose assets for high-growth sectors. The success of this gambit hinges on miners' ability to monetize AI capabilities before debt servicing costs escalate.

21Shares Files for 2x Leveraged Bitcoin ETF in the U.S.

21Shares has submitted a filing for a 2x leveraged Bitcoin ETF, dubbed HYPE, marking a bold MOVE in the crypto investment space. The proposed fund aims to deliver twice the daily performance of Bitcoin, catering to investors seeking amplified exposure to the leading cryptocurrency.

Leveraged ETFs remain a niche but growing segment of the crypto market, offering institutional and retail traders tools to magnify returns—and risks. The filing signals confidence in Bitcoin's maturation as an asset class, despite regulatory hurdles that have stalled similar products in the past.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical analysis and market fundamentals, BTCC financial analyst Sophia provides the following Bitcoin price projections:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $85,000 - $120,000 | Market consolidation, ETF developments, regulatory clarity |

| 2030 | $180,000 - $300,000 | Increased institutional adoption, halving cycles, global adoption |

| 2035 | $400,000 - $600,000 | Maturation as digital gold, scarcity premium, technological upgrades |

| 2040 | $800,000 - $1,200,000 | Full integration into global finance, store of value status |

Sophia cautions that 'these projections assume continued adoption and favorable regulatory developments. Current market conditions represent a healthy correction within a longer-term bullish trend.'